During a period of rapid commercial growth in 16th century England, the Muscovy Company was granted a charter by Queen Mary Tudor in 1555, giving it a monopoly over trade routes to Russia.

The company had recently been founded by various London merchants and its governor was Venetian explorer Sebastian Cabot.

At the time, companies needed a charter from the Crown to operate, and this licence for operations was time-limited and subject to the caprice of the King or Queen. It was not a right to form a corporation then, it was a privilege.

Chartered companies were organised as partnerships or guilds, which were owned by closed groups such as families or associations of businessmen.

But the Muscovy Company popularised what would prove a revolutionary innovation: it was able to raise enough money to finance the long journey to Russia by selling tradable shares.

“Joint-stock” companies, as they became known, was a new concept in English law.

The corporate form has existed as far back as the Roman Republic, and likely before. Despite coming to rule much of the world, the Roman Republic always had a small bureaucracy. One of the major reasons was its use of private businesses, in the form of societas publicanor.

These ancient economic instruments were recognised as an entity separate from its owners and had shares representing ownership interests.

The form developed further with the advent of modern banking with the House of Medici in Renaissance Florence, which saw the birth of what we now call a holding company.

But the modern corporation, as we understand it, really began its journey in 16th century England with Muscovy’s joint-stock model. It was not a coincidence it so decisively took off then: it proved particularly well suited to the grand voyages of the so-called Age of Discovery.

Age of Discovery

In 1498, Portuguese explorer Vasco da Gama had sailed around the Cape of Good Hope at the southern tip of Africa and arrived in India.

The journey marked the beginning of a new era in European history, when navigators set out on voyages around the world seeking new and exotic riches to be sold back home.

The joint-stock model allowed businesses to sell stock in their companies to investors, who would pay in cash up front in return for a slice of future profits down the line.

At the time, these trading companies had high up-front costs in terms of preparing their ships and missions. The profits from their long trips, meanwhile, were far from being immediately realised. If they came at all, they may be banked possibly years down the line: many of the voyages involved going half way around the globe and back again.

The joint-stock company ushered in a new era of global commerce. It was this model that propelled the signature corporation of the next 200 years, the East India Company, to global power. Founded on New Years Eve of 1600, it was given a charter by Queen Elizabeth I that gave just over 200 men control of a trading territory that covered a majority of the earth.

Limited Liability

But as chartered companies expanded their empires around the world, there was a constraint on the corporate form that was holding it back from realising its true potential. This was the legal concept of unlimited liability, which meant owners of companies were liable for losses incurred by the company.

At the opening of the 19th century there was a strong push in the business community to introduce limited liability, which would restrict the losses incurred by investors only to the capital they had invested.

Unlimited liability was proving a restriction on firms ability to raise capital. Business leaders argued that if British dominance was to be maintained it would have to introduce limited liability into law. The UK government, meanwhile, was worried about losing business to foreign countries where limited liability had been enacted.

Prominent liberals like John Stuart Mill were also arguing that limited liability would open up the world of business to the poor because it would lower their risks.

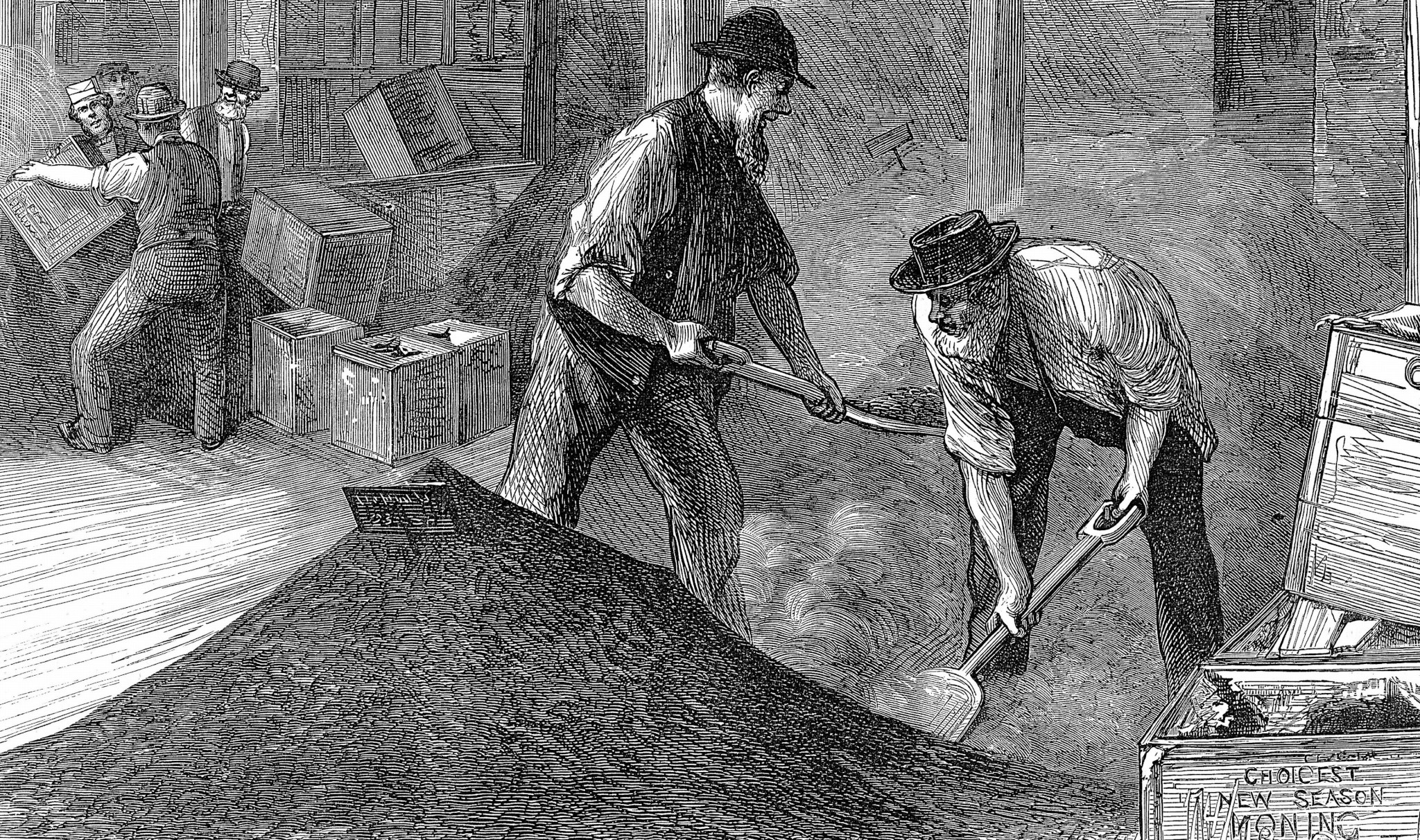

Legislation was introduced incrementally. The Limited Liabilities Act of 1855 explicitly allowed for limited liability for British corporations for the first time. The Joint Stock Companies Act of 1856 added to this, allowing business to obtain limited liability with “a freedom amounting to a licence”.

This, slightly modified, was subsumed into the more sweeping Companies Act of 1862. Almost 25,000 limited liability companies were incorporated between 1856-62. In the three years following the 1862 Act, new issues averaged £100m a year.

Commercial laws

In the 19th century Britain’s economy was the most important in the world, and efforts to free the corporate model, which was driving much of its growth, continued apace.

A major force behind the changes was the advent of the railway, which required huge amounts of capital upfront to design and build the new networks. The Liverpool-Manchester line was established in 1830 and was the world’s first regular passenger railway. By 1830, chartered joint-stock companies had built 2,000 miles of track.

Another restriction on the corporate form which was soon dispensed in this period was with the need to get a charter from the Crown or parliament to operate. The Joint Stock Companies Act of 1844 allowed companies to become incorporated by a routine act of registration rather than having to obtain permission from the state. This effectively unleashed the corporations from any kind of direct state control.

The company form developed in Britain as a result of legislative reforms, responding to technological innovation and expanding corporate empires. But the changes established in 19th century Britain, and the debates surrounding it, have coloured the institution ever since. The limited liability public companies we see now are not much different to the model finalised in that period.

By the end of the 19th century, in Britain, this new economic instrument had reached close to its final form and was basically independent of the state. It was the first autonomous institution in many centuries, creating a rival power centre to the government, which has now become arguably more powerful.

Britain was the pioneer in setting companies free from state control. From there, they have cannibalised the state that created it in the UK, but also around the world.

Silent Coup: How Corporations Overthrew Democracy is out this month from Bloomsbury Academic.